Tether is an accident waiting to happen … obviously!

Tether ($USDT) is an accident waiting to happen — obviously! But Tether is also something else — potentially the greatest currency trade in decades! In short, it represents an opportunity for a simply colossal “asymmetric trade” — in the same way that shorting the British Pound was a once-in-a-lifetime opportunity for Goerge Soros.

Breaking the Bank of England — The Perils of a Peg

Firstly though, what is an Asymmetric Trade? Very simply, these occur when a situation comes along in which the price of an asset can (realistically) only go in one direction (or else, stay basically flat).

In such a scenario, because there is no realistic chance of the trade going against you — the worst case being a flat price — you can LEVERAGE your position enormously by betting against the price staying where it is. This is nicely illustrated by the below chart.

Want an example? We’ve already mentioned it — “Black Wednesday”, when in September 1992 George Soros “broke” the Bank of England. He did this by wagering that the British Pound, which had been Pegged at 2.8 to the German Mark, would break below this “Peg”.

Why was this an asymmetric trade? Well, once the Pound had been Pegged to the Mark in 1990, the PRICE of the Pound would not change, even if — over time — the VALUE of a Pound DID change.

In practice, with UK Inflation at three times German levels and with the UK entering a recession as the German economy was booming — by 1992 there was no realistic prospect of the Pound doing anything but LOSING value when compared with the German Mark. But instead of the price of the Pound falling in line with its worth, the firm behind it — the Bank of England — stood ready to buy Pounds to keep the price Pegged. The BOE was also ready to raise interest rates to attract other buyers to buy Pounds.

This was obviously an unstable dynamic, where over time there would be diminishing confidence that the Peg could be maintained: either because the BOE would not be able to keep raising interest rates; or else because it would run out of reserves with which to buy Pounds.

What happened next?

Well, because of the certainty of the two outcomes — i.e. if the Peg broke the Pound would fall; and if it didn’t, it would simply stay flat — there was no incentive for traders to do anything BUT borrow Pounds and then immediate sell them to buy Marks.

The key here is the use of leverage — where it can not be emphasized enough that the presence of a Peg gave traders a free pass to borrow as many Pounds as they could in order to sell Marks; with absolutely NO RISK of the Pound trading above the Peg price.

At this point, George Soros took things to their logical conclusion — borrowing colossally to dump Pounds into the market. In doing so he put pressure on the price of the Pound and ensured that the BOE — the only buyer — had to dig into its reserves to keep the Peg.

Whilst this continued, the Market simply waited for the signal that would demonstrate beyond doubt that the game was up. When the signal came — loose comments from the head of the Bundesbank — the entire Market began rushing for the exit, selling huge volumes of Pounds to the BOE which was committed to buying them at the Peg price. After only a few hours however, and having lost an estimated $27bn — having also raised rates twice in one day (from 10% to 12%! and then to 15%!!) — the BOE called it a day, drew stumps and took the Pound off the Peg.

The result was a c. 15% fall in the price of the Pound (absolutely huge in currency Market terms) — and over $1bn flowing to George Soros’ fund!

What Does Any of this Have to do with Tether?

Well, there are a number of similarities, most notably that just like the Pound in 1992, Tether is a (Crypto) currency that is Pegged to another currency (the US Dollar).

Stepping back a moment though, why would somebody go to the trouble to create a Crypto currency that is Pegged to something else (and so giving no possibility of its price going “to the moon”)?

Well, the most obvious answer is that at most people still “think” in terms of Fiat currency, and more pertinently, they have their “real world” debts and liabilities (rent, taxes) denominated in their local “Fiat” currency.

It is also important to buyers and sellers in a trade that the currency used is less volatile than the leading cyrptocurrencies — where otherwise even an hours long gap between selling and buying something could be costly (even ruinous!)!

However, whilst the above gives two clear advantages to using Fiat Dollars — the Dollar nonetheless comes with its own disadvantages when compared to Crypto-currencies.

Firstly, for a transaction involving Crypto but where the buyer or seller are thinking in dollars, the sender will first need to set up a bank account, secondly to arrange for the bank to send his cash to a Crypto exchange and thirdly, once there to pay a commission to swap Fiat into Crypto. The recipient of the money will have exactly the same problems — except in reverse!

It is also the case that once a bank is involved in the transaction, control over the funds is lost — for example if a payment is delayed or halted (or confiscated!) for any reason.

And whilst some of these problems are maybe only slight inconveniences on their own, in a scenario where one needs to frequently buy, sell or receive cryptocurrencies’ — clearly the hassle and expense of continually swapping in and out of Fiat is going to be more than trivial.

Tether (and other Stablecoins) however offer a solution to both sides of this problem. Suddenly, decentralized money adopters get the full benefits of using a blockchain for trading — as well as the stability and universality of the world’s leading Fiat currency as a store of value and unit of account.

This is an attractive prospect, and it is not difficult to see why the leading Stablecons have been so successful (growing from nowhere to >$130bn in just a few years)! But can this best of all possible currency worlds be sustained? And why are users so confident that Tether USDT will maintain its Peg to the Fiat USD!?

Clearly many people — all around the world — are indeed confident in Tether, to the extent that $66bn is tied-up in it and where every day around $20bn of Tether is traded. Most importantly, for the last 4 years the price has barely moved from 1.0 USDT to the Dollar.

Why do People Treat Tethers like Dollars?

Where does this confidence in Tether come from however, and more specifically, how can Tether maintain its Peg? Well, on paper — this should be straightforward, where just like the BOE in the 90’s, Tether can look to sell assets (reserves) to buy Tethers in the market, thus keeping its price (f not maybe its value!) at 1:1 to the USD.

Indeed, in some ways, Tether has a better shot at keeping its Peg than the Pound did back in the 90’s. Why? This is because on paper, every single Tether token is backed by a corresponding amount in Dollars.

How does this work? Well, Tether claim that to create a Tether, they have to have been sent a Dollar. Tether consequently claim to hold — and be willing to exchange — enough Dollars to redeem each and every Tether for exactly 1 Dollar each.

This is a pretty powerful claim, such that — if taken at face value — how could the Peg ever be broken? Surely if every Tether is backed by a Dollar nobody would ever sell a Tether for less than a Dollar (when they could instead redeem it for a Dollar directly with Tether)?

Indeed, in any scenario where the price of Tether on an exchange fell below 1 Dollar, Tether themselves could simply choose to dip into their Dollar pile to buy back Tethers (for less than a Dollar) — and then exchange them (for a full Dollar!): and in the process making the easiest of profits!

Indeed, any individual with sufficient resources could also do the same. Given this then, in theory no amount of selling could ever break the Peg IF the currency has sufficient Dollars to keep buying all of the Tether tokens in issue.

Case closed? Not quite!

If we recall from the Pound’s “Black Wednesday’ experience — another way to maintain an exchange rate is by raising interest rates.

Can Tether raise interest rates to defend its Peg? Well actually — no it can’t because a Tether, just like a bank note, does not pay any interest.

But what if OTHER currencies RAISE rates — surely this impacts Tether? In some ways, in this scenario, the impact is the same as if Tether had LOWERED its interest rate — because like it or not, Tether DOES have an interest rate: it is just set at zero percent!

This was not a huge issue whilst interest rates were Zero — something which has basically been the case for the entire lifetime of the Crypto ecosystem — because in that scenario, interest rates for Tether were the same as the currency to which they are pegged.

But interest rates for the Dollar are now much, much higher than at any time in Tether’s lifetime. Indeed — they have risen from 0% over FY 22 to over 4%: a remarkable change in only a few months.

Why does this matter? Well, for some context, interest rate differentials are one of the MAIN drivers of the exchange rate markets.

Why? Well all being equal, if one currency has a higher interest rate than another — if the price of the two currencies never changed: traders would simply swap (sell) the currency with the lower interest rate and buy the one with the higher rate.

Over time — and assuming inflation in both currency areas is the same — the value of the currency paying the higher interest rate will grow at the expense of the one with the lower rate (as more people will look to buy it and fewer people would look to sell it)

Why is Tether any different?

Indeed, given the 1:1 Dollar Peg why would Tether owners not simply exchange their (0% return) Tethers for Fiat USD in an interest bearing bank account? Noting that if they do this, they will be able to buy more Tethers in the future!

For those who say this is nonsense because: i) Tether owners only need their Tether for a short period of time; and, ii) because Tether is asset backed and not Fiat. Well — hear me out!

Firstly, it is undeniable that the relative cost of using and holding Tether (for any period of time!) — goes up the higher Dollar interest rates go. At the margins, there has to be SOME marginal level of USD interest rate that tempts each individual user to sell.

Secondly, Whilst Tether is indeed asset backed, so were currencies that used the Gold Standard. Defenders of the Tether concept may be interested to learn that interest rates — and occasionally exchange rates! — on the (asset backed) Gold Standard DID change periodically!

A White Paper of No Interest!

Given all of this — where managing interest rate differentials is one of the central aspects of managing a currency — I assumed that there would be something explaining how this is managed in the Tether white paper.

Incredibly however, when reading the White Paper, I was astonished to see that there is NO reference to interest income or interest rates at all!

WOW!

Is Tether actually serious!? Maybe not!

Consider, Tether is meant to be a currency maintaining a Peg against another currency! I mean, you could Peg to a commodity in this way — because these do not have a yield. But the Dollar, which is a currency, DOES have a yield!

In fact, ANY currency will have a yield because whilst cash bank notes will not pay interest, in reality you can put the cash anywhere and get a return.

As such you get paid to hold a currency: and this is the bedrock of the entire global financial system (and is why each and every global financial market — including crypto — hangs on Jerome Powell’s every word).

Given this, you should expect that anybody exchanging cash for something without a yield will need some kind of compensation — which for gold or shares (say) might be that the price could go up. But with Tether that is impossible.

Tether is Not the Exception

And I get it, Tether is a currency that is meant to be used for short periods to trade in and out of Crypto positions or move money overseas or do some maybe not totally legit things. And for those purposes you are not looking for an interest rate — just a means of payment.

But to be a currency, you need to be able to transfer value across BOTH location (Tether being good for this) AND time (Tether being VERY bad at this) — in that you will want the currency to hold its value in the future.

Why is Tether bad at this? Well if you take a hundred Dollars today and buy Tethers: in 5 years time you will clearly be worse off vs simply holding the money in Dollars (and accruing interest). At 4% interest rates — you might be missing out on around $21!

Worse, even if the Dollar loses value due to inflation or a general loss of confidence, Tether will also lose value: without the compensation of higher interest rates to make up for the losses!

And — maybe most importantly — unlike gold or shares, Tether is meant to be effectively fungible with the Dollar. How though can Tether be fungible with something that is to all intents and purposes worth more than it?

I mean — if Tether was totally frictionless and with next to zero transaction costs — then as above, if USD interest rates are higher than zero, not a single person would be incentivized or sensible to hold Tethers for any period of time.

In short how can something without an interest rate be fungible with something that DOES have an interest rate — something that loses value by the day with something that gains value? How does that work? The white paper has NOTHING to say on this topic.

Thinking about this more broadly, why is this omission in the white paper maybe MORE than slightly odd?

Well firstly, let’s think about how Tether is meant to work. You send Tether Limited (in Hong Kong) some Fiat USD and they then create an equivalent amount of Tether token and send it to you.

The White Paper makes a big deal about how this is all tracked via blockchain and that there can’t be an excess of Tethers over the Fiat reserves — but it says remarkably little about how the actual Fiat side of things is managed.

Regardless, on paper it should all still work, where ultimately holding USD should be fairly simple.

Tether Limited can park the first few $billions into cash bank accounts, and after that they can buy short dated treasury bills. Finally, if the short end of the treasury Market ever became illiquid, they could look at money Market funds and short dated AAA commercial paper.

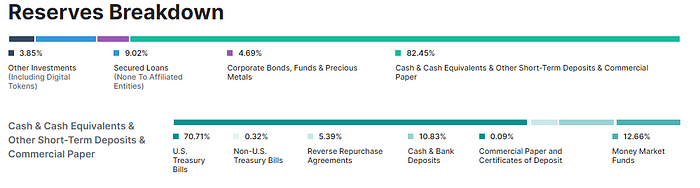

How does Tether actually manage their reserves in practice? We know that Tether has issued USTD Dollar $66.2bn of Tether, backed by $66.5bn of “assets” which it claims is MOSTLY (82%) parked in cash, treasury bills and money market funds.

But as at October 2022, this $66bn also included: $2.5bn in “Other Investments — including Cryptocurrencies(!)”; $6bn in “Secured Loans”; and, $3bn in “Crporate Bonds and Precious Metals”.

As a complete aside, the question arises why Tether would need to invest a single cent in anything not immediately liquid and dollar-like — it is hard to square the concept of what Tether is trying to do with what it has actually one.

Even so, why are these other investments important? Well these $12bn or so of “other” assets represent c. 20% of total reserves and are clearly NOT cash or even CASH EQUIVALENTS. I.e. if you held these you may not be able to immediately convert them into Dollars.

Indeed, with these kind of assets there is a very real possibility that you might never get back the Dollars at face value — even after a delay (in the case, say, of a corporate loan defaulting or the value of precious metals or cryptocurrencies falling).

Why does this matter — I mean, if Tether has 80% available in ready reserves, and the remainder is worth SOMETHING, then things will have to get pretty hairy before you could lose money? Well, not really!

Let us remind ourselves that the whole premise of Tether is that 1 Tether is meant to be worth 1 Dollar. And not only that — that holding Tether is meant to be just as risky as holding 1 Dollar.

We have seen however that this not the case — Tether is not delivering on its premise! Firstly, holding 0% interest rate Tether will be less valuable than holding 4% returning Dollars; and, secondly, Tether is not fully backed by Dollars — this is a fact!

What does this mean? It means that firstly every holder of Tether that does not need to immediately transact into Crypto has an incentive to sell Tether and buy Dollars. THIS IS THE KEY ISSUE!

Because, whilst Tether might be 82% backed today, we should assume that every time a Tether is redeemed for Dollars — the more liquid, cash like, Dollar assets are liquidated first to fund the redemption.

If this is the case, the implication is that over time: a) the number of Tethers should reduce (as more holders redeem for USD); and, b) that the non-cash like portion of the reserves will increase as a share of the total — making Tethers ever decreasingly less Dollar-like.

A Worst-Case Scenario — or what happens next?

Let’s picture here a scenario where 50% of Tether is redeemed in a very short period (a plausible scenario given the much higher interest rates available in USD since October).

As above, presumably the cash in the bank, the Money Market funds and the T-bills will be the first things to be liquidated to fund the redemptions.

Now, in this scenario, the proportion of Tether that is backed by USD equivalents will be MUCH lower. Say falling from 82% today to only around 60%. Will Tether holders still regard Tether as being 1:1 to the USD?

Or maybe more likely, will AT LEAST SOME Tether holders start to worry that they will be the last ones to redeem for Dollars— and so become concerned about being left holding the bag containing c. $12bn of “Other Investments” or “Secured Loans”.

Once we get to that stage we can anticipate a very rapid quickening of redemption requests and in all likelihood a delay in the redemption process. In this scenario, panic would likely set-in, and people would look to exchanges to exit their Tethers.

At this point, the Peg WILL break and Tethers WILL trade below 1:1 — with the price finally beginning to reflect the (by this stage) much lower value of what would be an illiquid pool of opaque assets held offshore. For Tether — this is where the story would end!

The Impossible Trinity — or How Tether (doesn’t) Solve It

Don’t believe this scenario Well let us consider — finally — one of the absolute iron laws of economics: the Impossible Trinity!

This theory posits that anybody managing a currency must choose between capital mobility; exchange rate management (to Peg or not to Peg); and an independent monetary policy (interest rates).

Taking this law at face value and viewing Tether through its lens is an interesting exercise! Firstly, the whole point of Tether is that it is mobile; and, secondly, Tether should not expose its holders to any exchange rate risk (i.e. it is Pegged to the USD): given both of these positions — Tether CAN NOT expect to have an independent monetary policy.

And yet — Tether DOES have an independent monetary policy — its policy is to keep rates at 0% in perpetuity. Yet, nowhere in the white paper does it mention this, the Impossible Trinity or even interest rates/monetary policy at all!

The simple implication of all this is that when events conspire against it, Tether will not be able to do at least one of: i) maintaining the USD Peg; or, ii) the ability to redeem Tethers instantly; or iii) to maintain an interest rate at zero.

Given the paucity of its reserves above its liabilities (where has the interest income gone?) I suspect that only one of the first two options will be available to the managers of Tether: either dropping the Peg; or stopping redemptions. Time will Tell!

And in the meantime — the field is clear for the next George Soros to borrow as much Tether as he/she can get their hands on and to quickly swap this for real Dollars!